Browsing: Ingredients

In a competitive market, the quality of food ingredients and food additives is key. Read the latest news on everything relating to the food ingredients industry: colouring, emulsifiers, preservatives and sweeteners, through to berries, nuts, herbs, spices, fruit and vegetables. Find out what’s happening in the world of food ingredients suppliers and manufacturers.

Massey food tech passes 50 year taste test

When Massey’s Bachelor of Food Technology degree was introduced in 1964, it was a first for New Zealand. Continue →

Ancient grains advance on tradition, nutrition and naturalness

Ancient grains are continuing their return to consumers’ diets, reflecting rising levels of awareness of their nutritional properties, as well as the unique flavours that they can impart to a wide range of food and drink products. Continue →

New Zealand’s favourite honey revealed

The popularity of Manuka honey has been confirmed in a recent national survey, which places it above Clover and other floral varieties. Continue →

The right fibre combination for healthier baking

Soluble and insoluble fibres produce successful results in added-fibre bread and sponge cakes. Continue →

Leading expert wary of adding some medicinal properties to wine

Aleading New Zealand toxicologist is in two minds about applying medicinal additives to food or wine. Continue →

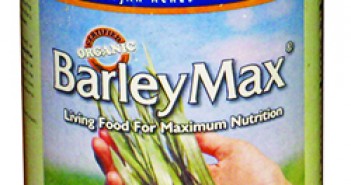

Supergrain tipped to help prevent diabetes

The new BARLEYmax™ ‘supergrain’ is now available to New Zealanders wanting to improve the nutritional value of their breakfast. Continue →

Food science that fools hunger pangs

Feeling full for longer to satisfy appetites and help reduce snacking between meals is one of the solutions to reducing the amount of food we eat. Continue →

Scientist to take up role in multinational food company

After nearly three years at the Riddet Institute as a postdoctoral fellow, Sophie Gallier is off to Danone Research in Utrecht, The Netherlands, to take up a role as Research Scientist. Continue →

Fruity flavours favoured in new yogurt formulations

Fruit flavours dominate the yogurt market, featuring in over two-thirds of global launches recorded by Innova Market Insights in the 12 months to the end of March 2013, rising to three-quarters of the USA total and nearly 70 percent in Latin America. Continue →

Blackcurrants can aid mental alertness

A recent study suggests that New Zealand blackcurrants can help manage your busy work day. Continue →

Organic cranberry powder with added health benefits

Naturex has launched Europe’s first clinically proven – and proanthocyanidin (PAC) standardised – organic cranberry powder targeting urinary tract health. Continue →

Affordable dairy ingredients may relieve child hunger

Dairy ingredients could be the key to effective, affordable foods for moderately malnourished children, according to studies presented by international food aid specialists at the first Arla Foods Ingredients food aid seminar held recently in Denmark. Continue →

Kale reinvents itself with health, quality and availability focus

Kale, or borecole, part of the Brassica family of vegetables, is currently riding high in markets such as the US and the UK. Continue →

Clean label Natural Improvers toolbox set to transform baking

Arla Foods Ingredients has developed a ground-breaking ‘toolbox’ of natural improvement solutions offering bakers optimised production processes, better quality end-products, reduced waste and cleaner labels – all at the same time. Continue →

Caldic expands to Pacific regions

Caldic B V, distributor and producer of food ingredients and chemicals, continues its expansion and growth in the food ingredient market through the creation of Caldic New Zealand Ltd, based in Auckland. Continue →

Cutting salt and boosting taste

DSM’s salt reduction toolbox allows manufacturers to reduce sodium in savoury products by up to 50 percent without losing taste or mouthfeel. Continue →

Researcher uses kumara to alleviate vitamin defiency

A Massey University PhD student has developed a complementary food for infants in developing nations that could help minimise vitamin A deficiency. Continue →

Tempeh – a healthy, fermented soy product

By Professor Steve Flint

Tempeh (pronounced TEM-pay) is a popular Indonesian food consisting simply of fermented soybeans, or occasionally other legumes or grains. Continue →

Christchurch bakery makes best bun

A Christchurch bakery is the winner of the Great New Zealand Hot Cross Bun Competition. Continue →

Jamieson Laboratories relies on Impulse grader from Symetix

As Canada’s oldest and largest manufacturer of natural vitamins and minerals, Jamieson Laboratories is a market leader that has earned that position by consistently providing innovative products of the highest quality, purity, and safety. Continue →